In this Article

Av Matteo Alessandro

Have you come across the MFSA ‘s new NFT guidelines? Av. Matteo Alessandro conducts an in-depth analysis of the new NFT guidelines, including how NFTs have been classified, and how this has affected regulation. Moreover, Av. Alessandro reveals the communication MK Fintech Partners held with the Authority, and further praises them for their commitment to the cause. For further information or assistance, feel free to get in touch with us: contactmkfintech@kyprianou.com.

The Background

MFSA’s New NFT Guidelines

In December 2022, the Malta Financial Services Authority (MFSA) issued a consultation document on how to handle Non-Fungible Tokens (NFTs). This was the MFSA’s answer to the recent emergence of NFTs in the Distributed Ledger Technology (DLT) sphere. In fact, the MFSA clearly understood the importance of clarifying the treatment of NFTs, since these were being used more and more widely everyday, leading to a lacuna which could lead to uncertainty and abuse. Consequently, MFSA published its guidelines on the treatment and classification of NFTs.

The Classification of NFTs

The MFSA’s initial position was to consider NFTs as Virtual Financial Assets (VFAs). This is because of the VFA Act, which defines NFTs as:

“any form of digital medium recordation that is used as a digital medium of exchange, unit of account, or store of value and that is not –

(a) electronic money;

(b) a financial instrument; or

(c) a virtual token.”

In our response to the consultation document, we argued that NFTs are not intrinsically a digital medium of exchange, nor a unit of account, nor store of value. Therefore, we consider that are not a de facto VFA. Nevertheless, we also argued that the characteristics of individual NFTs should be considered, not the technology in and of itself.

What happened next? Well, the MFSA adopted a similar position. In fact, the Authority is now noting that NFTs are not necessarily VFAs. Furthermore, the MFSA also notes that NFTs could be considered as other DLT assets (including financial instruments), depending on their use. This position also follows the terms of the Markets in Crypto-Assets Regulation (MiCA) recently adopted by the European Parliament.

The MFSA’s Guidelines

The MFSA’s newly-issued guidelines are applicable to issuers offering NFTs and to persons providing any service or performing any activities related to NFTs. Furthermore, these shall be applicable from July 1st, 2023.

Consequently, the guidelines maintain that if an NFT is not determined to be a DLT asset, it shall only be subject to the guidelines, and not the VFA Act. The MFSA based this guideline on the established criteria; however it is important to note that certain NFTs may still have DLT asset implications, and thus the classification should be determined using the Financial Instrument Test, adopting a “substance-over-form” approach.

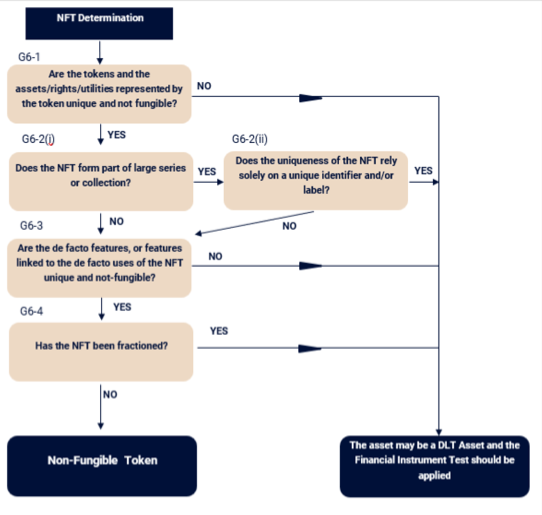

In order for a token to classify as an NFT, the MFSA requires the following:

An NFT should be unique and not fungible where the NFT is unique and not fungible with other assets and the underlying asset/s, right/s and/or utility/ies represented by the NFT are also unique and not fungible.

However, it is also important to note that NFTs issued in a large series may be considered to impact the NFT’s fungibility . This means that the fungibility of an NFT is not based solely on its unique identifier, but rather its true purpose. These stipulations clearly answer one of the issues we submitted to the MFSA, wherein we argued that if NFTs as a whole are excluded, issuers may issue tokens which are usually considered VFAs (such as cryptocurrency), and use the NFT model in order to circumvent regulation.

The MFSA further emphasises the importance of considering the actual rights, assets, and utilities an NFT provides. This follows the reasoning present in MiCA: in that if the rights, assets, or utilities are not truly non-fungible, then the token is considered to be fungible. Moreover, the MFSA has also provided for the issue of fractionalised NFTs, in that “each fractional NFT should not be considered unique and not fungible, irrespective of the purpose of the NFT or the fractional NFTs.”

The following flowchart has been provided by the MFSA, in order to facilitate the regulatory classification of NFTs:

The Breakdown

The MFSA’s impetus in relation to NFTs clearly shows the Authority’s willingness to adopt a technologically neutral approach. Shadikhodjaev holds that:

“[The] principle of technological neutrality […] prevents rules from favouring or discriminating against a particular technology in pursuing regulatory objectives. Depending on the legal context, this principle may call for regulating the effects of technology use rather than the technology itself, [and banning] discrimination between technologies with essentially identical effects or functions […]”

Concluding Remarks

MFSA’s New NFT Guidelines

In summary, a technologically neutral approach does not consider the underlying technology, but rather, how it is being used. We believe that this approach will have two main benefits:

We appreciate the MFSA’s acknowledgement and acceptance of our feedback, and would like to praise their consultative approach in this matter. These guidelines will allow Malta to be at the forefront of technological innovation, while still ensuring legal certainty.

How Can We Help?

We cover the regulatory and technical aspects of blockchain and financial technology across major industries and various jurisdictions. This allows you to focus on innovation and your business goals. Feel free to get in touch with contactmkfintech@kyprianou.com to discuss your idea!

More about MK Fintech Partners Ltd.

Michael Kyprianou Fintech Partners Ltd. is a Maltese company providing services in the FinTech sector. It comprises a team of dedicated experts who provide services such as Legal Advisory, Crypto Licensing, Token Issuers’ Licensing, Investment Services Licensing, and registrations of activities related to Fintech, Crypto, Blockchain & Data Protection, Investment Funds Services & Banking, Company Incorporations, and M&As.

MK Fintech Partners forms part of the Michael Kyprianou Group, a top tier international legal and advisory firm. It has established an enviable reputation as a broad-based legal practice over the years. Mainly by keeping at heart its principle to always exceed its clients’ expectations. MK has grown to become one of the largest law firms in Cyprus with offices in Nicosia, Limassol and Paphos. The MK Group’s international presence also includes fully-fledged offices in Greece (Athens and Thessaloniki), Malta (Birkirkara), Ukraine (Kiev), the United Arab Emirates (Dubai), United Kingdom (London), Israel (Tel Aviv), and Germany (Frankfurt).

The content of this article is valid as at the date of its first publication. It intendeds to provide a general guide to the subject matter and does not constitute legal advice. We recommend that you seek professional advice on a specific matter before acting on any information provided. For further information, contact us at MK Fintech Partners via email at contactmkfintech@kyprianou.com or by telephone +356 2016 1010.